Expanding supply chains the Chinese way

The Pingxiang land port in China's Guangxi Zhuang autonomous region in South China, Jan 8, 2023. [Photo/VCG]

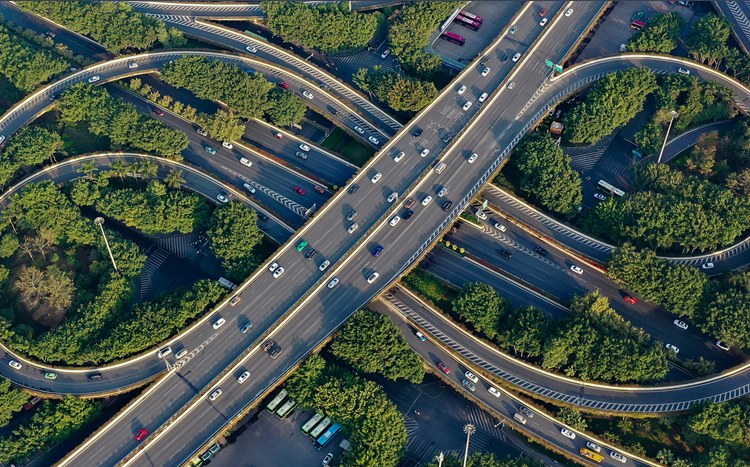

One midnight recently, the Pingxiang land port in China's Guangxi Zhuang autonomous region in South China was bustling with activity. Kilometer-long lines of trucks, heavily pregnant with raw materials, intermediate goods, parts and accessories, awaited entry into Vietnam.

The goods, bound for plants of both Chinese and global companies in Vietnamese provinces such as Nam Dinh, Bac Ninh and Binh Duong, originated from suppliers in the Pearl River Delta region of South China.

At their respective destinations, the products will be sorted, allocated and assembled in various workshops. The finished products, like household appliances and smartphones, equipped with various types of charging plugs, will be shipped worldwide, including China, Spain, Egypt, Qatar, South Africa and Argentina.

This is a prime example of how Chinese companies are expanding their supply chains and market presence in Southeast Asia. Since 2018, numerous Chinese firms have been making inroads into countries within the region to establish a foothold. Some are seeking to lower their labor and export costs, while others are drawn by favorable local tax policies.

Driven by changes in the international trade environment and industrial development trends, a number of Chinese companies have flocked to Southeast Asia to invest and set up factories. Many of them have found that development in Southeast Asia is still in a relatively early stage.

Whether it is due to a saturated domestic market in China that is facing fierce competition and where successful, mature business models are the order of the day or due to the challenges smaller businesses face in securing a foothold in China, Southeast Asia presents an enticing opportunity for lucrative returns. This is further enhanced by the region's vast market size, immense consumption potential, geographical proximity and the strong government support from member countries of the Association of Southeast Asian Nations.

Owners of several factories in Southeast Asia have told me that countries like Vietnam provide not only tariff benefits for imports and exports but also the advantages of low labor costs and limited industry competition. In such countries, worker wages are only one-third to half of those in China, which helps keep labor costs down.

They further said that due to Vietnam's modest level of industrialization, the influx of Chinese companies into the country makes it difficult for competitors to encroach on their market share, creating a relatively comfortable environment for business survival.

Considering the resource endowments and industrial structure, the economic complementarity between China and ASEAN member countries outweighs their competition, offering considerable growth opportunities.

After years of development, China's foreign trade structure with ASEAN countries has shifted from resource-based products to mainly electromechanical products and high-tech products, indicating that the trade complementarity between the two sides is continuously strengthening and the trade structure is constantly optimizing.

ASEAN remained China's largest trade partner in the first two months of 2024, while China's trade with ASEAN countries rose 8.1 percent year-on-year to 993.24 billion yuan ($137.39 billion), accounting for 15 percent of China's total foreign trade value, statistics from the General Administration of Customs showed.

The main reasons for these developments are the transformation and upgrade of China's industrial structure, along with the tangible growth opportunities brought by the Belt and Road Initiative, the Regional Comprehensive Economic Partnership, the New International Land-Sea Trade Corridor and the China-Laos Railway.

By establishing industrial cooperation parks in Thailand and Malaysia in recent years, China has also bolstered collaboration in the vertical division of labor within the industrial chain with Southeast Asian countries.

These initiatives will enable collaboration with Southeast Asian countries in the middle and lower-tiers of the industrial chain, thereby increasing the added value of their products and improving the integration capacity of industrial chains.